Budgeting for Your Golden Years: How Much Should You Spend on Housing in Retirement?

Retirement is a time to enjoy the fruits of your labor and embrace a new chapter of life. However, making sound financial decisions remains crucial, especially when it comes to housing. How much should you allocate to your living expenses and how much house can you afford in retirement? Let's explore the factors to consider and how independent living communities like Acts can offer a fulfilling and cost-effective solution.

How Much House Can I Afford in Retirement?

Financial experts generally recommend that your total housing expenses, including mortgage payments, property taxes, insurance, and maintenance, should not exceed 30% of your overall retirement income. This allows you to comfortably cover other essential costs such as healthcare, transportation, food, and leisure activities.

Factors to Consider When Determining How Much to Spend on Housing in Retirement

When answering the question “how much house can I afford in retirement?” consider the following factors:

Your Retirement Income Sources: Evaluate your expected Social Security benefits, pension income, retirement savings withdrawals, and any other sources of income. This will help you determine your overall budget.

Debt Obligations: If you have any outstanding debts, such as a mortgage or car loan, factor in those payments when calculating your housing budget. Ideally, aim to be debt-free or have minimal debt by the time you retire.

Lifestyle Choices: Consider your desired lifestyle and the activities you plan to enjoy in retirement. Do you want to travel frequently? Pursue hobbies? Spend time with family? These choices can significantly impact your overall spending and, consequently, your housing budget.

Healthcare Costs: Healthcare expenses tend to increase as we age. It's essential to account for potential medical costs and long-term care needs when budgeting for retirement.

Location: Housing costs vary significantly across different regions and states. Consider the cost of living in your desired location and whether it aligns with your overall retirement budget.

Housing Options for Retirees

Staying in Your Current Home: If you own your home and it's paid off or has a low mortgage, staying put may be a viable option. However, consider potential maintenance and repair costs, as well as property taxes.

Downsizing: Many retirees choose to downsize to a smaller, more manageable home. This can reduce housing costs and free up equity for other retirement expenses.

Renting: Renting an apartment or condo can offer flexibility and eliminate the burdens of homeownership. However, rent payments can fluctuate and may not be as predictable as a fixed mortgage payment.

Independent Living Communities: These communities offer a maintenance-free lifestyle, social engagement opportunities, and often a range of amenities and services. They can be a cost-effective option for retirees, as they typically include utilities, meals, and other expenses in the monthly fee.

Independent Living at Acts: A Smart Choice

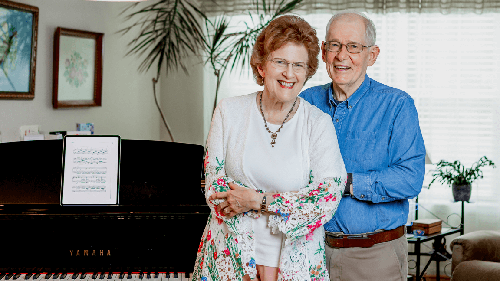

At Acts Retirement-Life Communities, we understand the importance of financial security and peace of mind in retirement. Our independent living communities offer a vibrant and fulfilling lifestyle, along with predictable monthly fees that help you manage your budget with confidence.

With spacious apartments, a variety of amenities, engaging activities, and a supportive community atmosphere, Acts’s campuses provide the ideal setting for baby boomers to thrive in their retirement years. Plus, our continuing care options offer access to assisted living, skilled nursing, and memory care if needed, ensuring you have a plan in place for the future.

Get the Most Out of Your Retirement

Don't let worries about how much house you can afford in retirement overshadow your golden years. By carefully planning your budget and exploring housing options like independent living communities, you can ensure a comfortable and financially secure retirement. At Acts, we're committed to helping you make the most of this exciting chapter of your life.

Explore our many spectacular independent living communities and learn how we can help you achieve your retirement goals.