New Rules: 7 Changes to Retirement Planning

If you’re approaching retirement age, you know how crucial it is to plan accordingly. Without planning ahead, you run the risk of not having the financial resources necessary to enjoy your retirement to the fullest.

That’s why it’s so essential to stay on top of any new rules or changes to the law that can affect how retirement planning is done. These laws change periodically, but one of the biggest upcoming changes is right around the corner, thanks to the SECURE Act 2.0, which was signed into law in December 2022. Here’s how this new legislation changes your retirement planning.

What Is the SECURE Act 2.0?

In December 2022, the Consolidated Appropriations Act of 2023 (HR 2617) was signed into law. The Act makes many new changes that affect retirement savings plans in the same way that the 2019 SECURE Act did. In fact, the Act has been nicknamed “SECURE 2.0” to highlight the intention of reinforcing and supporting these initial changes.

Crucial Changes Introduced by the SECURE Act 2.0

SECURE 2.0 offers many new benefits to both employers and employees, all of which are designed to make it more attractive for employers to offer retirement plans to their workers and to improve their employees’ retirement outcomes. There are close to 90 different provisions that make up SECURE 2.0. We can’t possibly cover all of them, but we are going to underline some of the most important.

RMD Start Age Extended

One of the most significant new changes to retirement plans is the increase in the age to start required minimum distributions (RMDs). If you’re unaware, an RMD is the amount of money that needs to be withdrawn from employer-sponsored retirement plans like IRAs every year after you reach a certain age. Under current law, RMDs must begin at age 72.

However, the SECURE Act 2.0 delays the start of RMDs to age 73. This means that people who are nearing retirement can keep their retirement savings in their accounts for longer, which can help grow your savings to have more money in retirement.

Catch-Up Contribution Limit Raised

Another important change is the increase in the catch-up contribution limit for individuals aged 50 and older. Catch-up contributions are a type of retirement savings contribution that allows anyone over the age of 49 to make additional contributions to IRAs and 401(k) accounts that would otherwise exceed the standard annual contribution limit. Under current law, the catch-up contribution limit for individuals aged 50 and older is $6,500. However, the SECURE Act 2.0 increases the catch-up contribution limit to $10,000. This means that people who are nearing retirement can save an additional $3,500 each year, which can help them reach their retirement goals.

New Retirement Account Created

The SECURE Act 2.0 also creates a new type of retirement account called the ABLE account, which stands for Achieving a Better Life Experience. ABLE accounts are designed to help people with disabilities save for retirement. ABLE accounts have a number of advantages over other retirement accounts, such as the fact that they do not have RMDs and that contributions are made with after-tax dollars. This is noteworthy for disabled Americans who may already face challenges in saving for retirement due to their disabilities.

Even More Retirement Planning Changes

Finally, the SECURE Act 2.0 makes a number of other changes that can benefit people who are nearing retirement. All of these changes are designed to make it easier for more people to save for retirement and to help people save more money each year, such as:

- Expanding automatic enrollment in 403(b) and 401(k) plans and expanding coverage for long-term part-time employees in 403(b) plans.

- Allowing withdrawals for certain emergency expenses.

- Catch-up contributions must be Roth IRA.

- Employer contributions as Roth IRA.

Understanding the New Changes to Retirement Planning by SECURE 2.0

If you are nearing retirement, it’s critical to understand the new planning changes made by the SECURE Act 2.0 and to take advantage of the opportunities these changes offer. By doing so, you can help ensure that you have a secure retirement. Here are some tips to consider if you’re nearing retirement and wondering how SECURE Act 2.0 will impact your retirement planning:

- Review your retirement savings. Make sure your retirement savings are on track to meet your retirement goals. If they are not, you may need to make some changes to your savings plan.

- Consider making catch-up contributions. If you are age 50 or older, you may be able to make catch-up contributions to your retirement savings. These contributions can help increase your savings and reach your retirement goals sooner.

- Consider converting your traditional IRA to a Roth IRA. If you are nearing retirement, you may want to consider converting your traditional IRA to a Roth IRA. This can help you save on taxes in retirement.

- Talk to your financial advisor. Your financial advisor can help you understand the changes made by the SECURE Act 2.0 and can help you develop a retirement plan that meets your individual needs.

SECURE 2.0 Changes to Retirement Planning

Retirement planning can be complex, especially as the options for retirement savings become more diverse and varied as legal regulations change. With the SECURE Act 2.0 offering a number of new opportunities for people nearing retirement, it becomes important to understand the changes made by this law. Taking advantage of the opportunities that it offers can help ensure you have a secure retirement.

This is why it’s highly recommended to speak with a qualified financial advisor with experience in retirement planning. Financial advisors will have the answers to all the questions you have about how SECURE 2.0 changes the retirement planning landscape. With their help, you can take steps to make sure your savings plans will suit you well when it comes time to retire.

Another Important Part of Retirement Planning: Healthcare

When planning for retirement, you can budget for many expectations. How will your food and entertainment needs change (eating breakfast out more often? Attending the movie theater more often)? How will your travel costs change?

One thing difficult if not impossible to predict is healthcare costs. We don’t know just how much costs will continue rising, nor do we know what our health needs will be as we age.

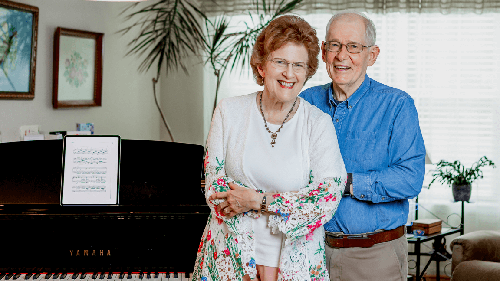

That’s why so many retirees are selling their homes and moving into continuing care retirement communities. CCCRs have all the amenities you might expect — swimming pools, fitness centers, gated neighborhoods with security — but feature the added benefit of included healthcare. For no increase to your costs, if you should ever need a higher level of care such as assisted living or skilled nursing care, it’s included right on the same campus.

This means you finally can plan your entire retirement budget, knowing your future health costs are secured!

Learn more by exploring any of the 28 resort-like CCRCs of Acts Retirement-Life Communities.