How Much Do I Need to Retire in Pennsylvania? A Guide to Financial Preparedness

With its blend of rich history, scenic beauty, and vibrant communities, Pennsylvania has long been a popular destination for retirees. But as you contemplate spending your golden years in the Keystone State, a crucial question arises: How much money do I need to retire comfortably in Pennsylvania?

The answer is not one-size-fits-all. Your retirement budget will depend on a multitude of factors, including your desired lifestyle, location, healthcare needs, and personal preferences. However, understanding the general cost landscape and potential expenses is a crucial first step in planning a secure and fulfilling retirement.

Cost of Living in Pennsylvania

The cost of living in Pennsylvania varies across different regions. The Philadelphia metropolitan area, where Acts has several communities, tends to have a higher cost of living compared to more rural areas. Housing, transportation, and everyday expenses can be more significant in the city and its suburbs. However, Pennsylvania also offers many attractive retirement locations with more affordable living costs, such as Buck County, or even deep to the “burghs” on the other side of the state.

Estimating Your Retirement Expenses

To estimate how much you'll need to retire in PA, consider the following key expenses:

- Housing: Whether you're considering buying a home, renting an apartment, or joining an independent living community, housing costs will likely be your most significant expense. Factor in mortgage payments, rent, property taxes, homeowners' insurance, and maintenance costs. Independent living communities tend to bundle these costs together.

- Healthcare: Healthcare expenses typically increase as we age. Medicare will cover a significant portion of your healthcare costs, but you'll still need to budget for supplemental insurance, deductibles, co-pays, and out-of-pocket expenses. Continuing Care Retirement Communities (CCRCs) allow you to prepay for much of your future health needs, so that if you or a spouse ever need a higher level of care such as assisted living, it’s already been taken care of without the additional burden of inflation.

- Daily Living Expenses: Factor in the costs of groceries, transportation, utilities, entertainment, and other everyday expenses. Your lifestyle choices and location will influence these costs.

- Travel and Leisure: Consider how much you'll want to spend on travel, hobbies, and other leisure activities during retirement.

The Benefits of Independent Living Communities

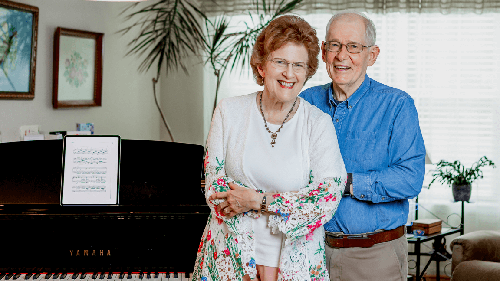

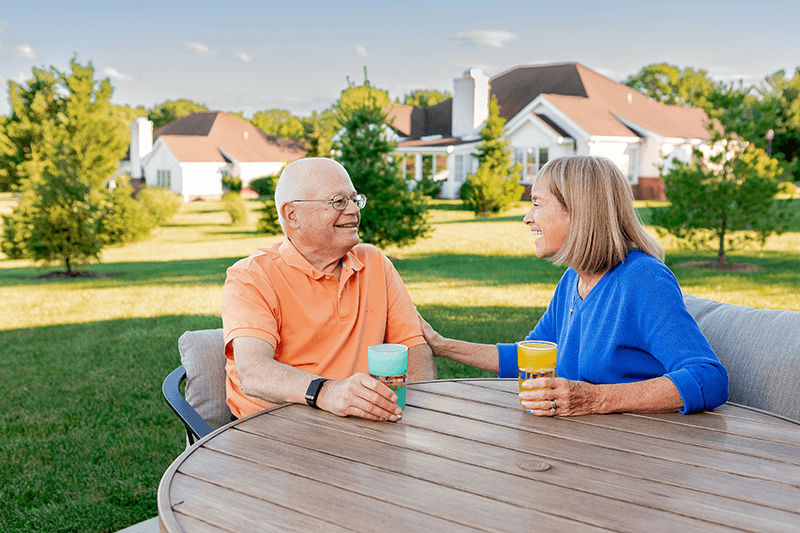

For those seeking a vibrant and worry-free retirement, Pennsylvania independent living communities like those offered by Acts can provide a compelling solution. While there are upfront and ongoing costs associated with community living, they can often offer long-term financial benefits and peace of mind.

- Predictable Costs: Independent living communities typically have predictable monthly fees that encompass a wide range of services and amenities, including housing, dining, utilities, maintenance, and activities. This can simplify your budget and eliminate unexpected homeownership costs.

- Access to Healthcare: Many communities, including Acts, offer a continuum of care, providing access to assisted living, skilled nursing, or memory care if your needs change in the future. This can safeguard your financial future and alleviate concerns about long-term care costs.

- Reduced Expenses: Community living can also lead to reduced expenses in other areas. For example, you may no longer need to pay for home maintenance, lawn care, or property taxes. Additionally, shared amenities and services can often be more cost-effective than maintaining them individually.

How Much Do I Need?

If you're considering independent living in Pennsylvania, we invite you to explore the communities offered by Acts Retirement-Life Communities. Our dedicated team can provide personalized guidance and help you find the perfect fit for your retirement goals and budget.