How to Plan for Healthcare Costs in Retirement

There is so much fun to be had when planning for your retirement. Planning where to travel, planning what new hobbies to take up, even planning where to live if you’re considering relocating.

But amidst all the fun planning, let’s not forget some of the other planning as well. Namely: planning for your future health.

The plan is to enjoy ourselves as much as possible, right? But we also must understand that there will come a time in our future where we need more support. And if we don’t prepare for those financial costs, we can’t truly know how much we’re able to spend while living our dream retirement.

To help, here’s some great advice on how to save for healthcare in retirement.

Step 1: Recognizing Medicare’s Limits

Thanks to our social safety net, U.S. citizens are typically eligible for Medicare upon retirement. This is good news for any older adult who’s concerned about staying healthy, as Medicare does go quite a long way to cover your routine checkups and other everyday expenses like prescription drug prices.

However, Medicare isn’t comprehensive enough, which means there are gaps in Medicare coverage that you’ll have to contend with if you need advanced healthcare. Your options are limited – you can invest in supplemental insurance, such as Medicare Part D or a private insurance policy, or you can pay out-of-pocket. The supplemental insurance route at least allows you to plan how much to budget for ongoing healthcare expenses in retirement, whereas if you opt to only use Medicare and pay out-of-pocket when needed, you can’t be sure when an emergency might strike and how much it will cost.

To us, one of the keys to enjoying retirement to the fullest is knowing how much you have to spend. That’s why mapping out how much you should budget for healthcare in retirement is so important. What are your living expenses, your food and travel and leisure expenses, and what are your health expenses? That needs to be planned for years or even decades in the future, so you don’t run out of money in the middle of your retirement.

Step 2: Plugging the Medicare Donut Hole

Since Medicare isn’t the perfect lone solution, it now comes down to finding ways to ensure you’re appropriately planning for healthcare costs in retirement. We mentioned supplemental insurance or rolling the dice with out-of-pocket costs. One way to ensure you have the extra resources available to you so that you can afford healthcare more readily is to reduce your other expenses to free up your financial resources in general. An example of this would be selling a second car that you no longer use as often, which removes ongoing car insurance and maintenance costs. You may even be able to put the proceeds from that sale into your nest egg.

Where else can you cut costs to ensure you’re saving for healthcare in retirement? There of course must be a balance — you don’t want to cut out all your fun activities. Fun is the whole plan, after all!

Another effective method for freeing up financial resources is to downsize your living expenses in general. The best way to do that is downsizing your property. If you’re still in your family home, and if it’s paid off or close to being paid off, you may be able to move to a smaller property (bonus: it requires less upkeep) and pocket much of the profit.

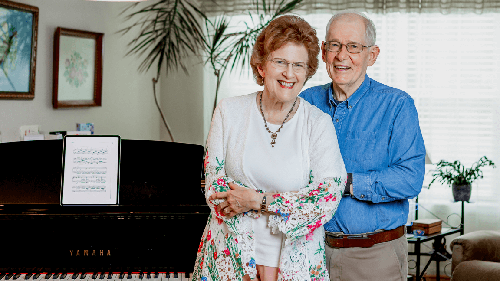

Another option, which combines downsizing with cutting outside expenses, is to move into a retirement community. Pause what you may be thinking of — we’re talking about upscale, sprawling campuses that provide a resort-like lifestyle for active retirees. Not only do they often cost less to join than a typical home sells for, but they include a number of dream retirement amenities — access to hobbies and activities, pools and fitness centers with trainers, fine dining options, local excursions, and much more. With no home maintenance needs, this means you curb many of your current expenses while getting to fully leverage the retirement dream.

How to Plan for Healthcare Costs with a Retirement Community

While you’re considering a retirement community, think about what’s called a continuing care retirement community, or CCRC.

CCRCs such as Acts Retirement-Life Communities take the experience a step further. They include health services right in the package, right on campus. This is bar-none the best way to plan for future healthcare costs, because it removes future healthcare costs.

Should you ever need a higher level of care, such as assisted living or even skilled nursing, it’s already included in what you’re already paying. Your monthly rate doesn’t increase just because your level of need does. It’s therefore the best of all worlds, giving you access to your dream retirement now, with access to health services should you ever need it, all for a consistent monthly fee. That way you can focus on how much to spend on spoiling your grandkids rather than worrying about saving for healthcare and other needs in retirement.

Start Planning for Healthcare Costs in Retirement

Using retirement planning options to ensure you have healthcare coverage during your retirement years doesn’t have to be challenging. With enough time and effort, you can set systems in place, like investing to provide you with retirement income, to ensure you’ve got additional resources you can call on during retirement if you ever need to. Putting more money into savings accounts prior to retirement is quite obviously another option if you can use this method. The key to being able to have fun is to also know how to plan for healthcare costs should anything change during retirement.

If you have questions about the healthcare costs associated with retirement or you’re looking for strategies to ensure you can pay for those costs without worry, reach out to Acts Retirement-Life Communities today.

You can explore any of our 26 beautiful campuses across nine states.