Should Retirees Be in the Stock Market?

Retirement is all about having the freedom – and the financial resources – to live life on your own terms. The time part? Easy. No more clocking in or answering emails. But maintaining the lifestyle you’ve worked so hard for? That takes some planning.

For most, retirement prep means building a nest egg, and often that includes investing in the stock market. But as many know, market volatility can throw a wrench into even the best-laid plans. A downturn can hit hard, especially when your investments are supposed to supplement your income. So, the big question is: should retirees stay in the stock market, or get out while they can?

Let’s break it down.

Should Retirees Get Out of the Stock Market?

Short answer: not necessarily.

There’s an old saying in investing - fear, uncertainty, and doubt are your worst enemies. When panic sets in, it’s easy to make emotional decisions that could end up hurting you more in the long run.

Take a breath. Market dips are unsettling, but historically, they’ve always been followed by recoveries. That’s why many retirees stick with a “buy and hold” strategy—riding out the lows to benefit from the eventual rebound.

Of course, every situation is unique, and speaking with a financial advisor is always a smart move. But if you're tempted to pull everything out during a dip, pause. Waiting it out might be the better option.

What Should Retirees Do in the Stock Market?

1. Diversify Your Portfolio

Every investment carries risk. But you can soften the blow of market ups and downs by diversifying your portfolio. The idea is so simple it’s become a cliche: don’t put all your eggs in one basket.

Many retirees use a balanced approach—like a 60/40 split between stocks and U.S. Treasury bonds. These assets often move in opposite directions, so if one takes a hit, the other can help cushion the fall.

The goal is to create a mix of investments that balance growth with stability.

2. Be Smart About Resource Management

Even if you stay in the market, it’s wise to protect yourself from financial shocks. That means:

- Keeping some savings in liquid, low-risk accounts

- Managing your living expenses to avoid overextending yourself

- Having a solid plan for accessing cash when needed

Low-yield savings accounts won’t grow your wealth, but they offer quick access in case of emergency. At the same time, trimming unnecessary expenses gives you breathing room if the market hits a rough patch.

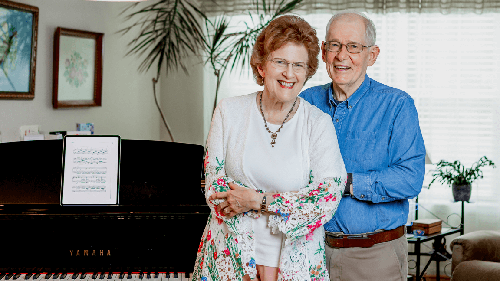

CCRC Living: A Smart Move for a Stable Retirement

One of the biggest expenses in retirement? Housing. That’s why many retirees are choosing to move into a continuing care retirement community (CCRC). These communities offer an all-inclusive lifestyle that can make retirement more affordable and less stressful. A single monthly fee typically covers:

- Maintenance and repairs

- Landscaping and snow removal

- Trash removal

- Utilities

- Property taxes (yup – they’re gone!)

- On-campus perks like gyms, pools, dining, and hobby spaces such as art studios, woodworking shops, and gardens.

Living in a CCRC simplifies your finances and lets you enjoy resort-style living without the hassle of homeownership.

CCRCs Help Manage Healthcare Costs, Too

Let’s face it—Medicare is helpful, but it doesn’t cover everything. Healthcare needs can change quickly, and costs for higher levels of care (like assisted living or skilled nursing) can skyrocket.

That’s where CCRCs really shine.

They offer a continuum of care—meaning you can stay in the same community whether you’re fully independent or need more medical support. Best of all? Your monthly fee typically stays the same, even if your care needs increase.

So if you move in healthy and independent, but later need assisted living, you’ll receive that care on the same campus without your costs increasing. That kind of predictability can be a game-changer.

Keep Calm and Carry On

Market dips and economic uncertainty can feel overwhelming, especially in retirement. But with a clear head and a good strategy, you can navigate it all with confidence.

Here’s what to keep in mind:

- Stay diversified with lower-risk investments

- Manage your cash flow and expenses

- Explore CCRC living for financial stability and peace of mind

To learn more about some of the best CCRCs in the country, check out what Acts Retirement-Life Communities has to offer.