Best States Financially for Retirement: A Balanced Look at 12 Options

Retirement is a significant milestone, and choosing the right location can greatly impact your financial well-being and overall enjoyment of this new chapter. While individual preferences vary, certain states stand out for their financial advantages, cost of living, amenities, and climate. If you're considering relocating for retirement and wondering what states are best financially for retirees, this article will explore 12 states—Alabama, Delaware, Florida, Georgia, Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, Tennessee, and Texas—and evaluate their financial benefits and potential drawbacks.

Tax Considerations for Retirees

Taxes play a crucial role in retirement finances. States with lower tax burdens can significantly stretch your retirement savings. Let's assess the tax landscape in the nine states:

- Alabama: Offers a relatively low tax burden for retirees, with no state income tax on Social Security benefits and a modest income tax rate. Property taxes are also moderate compared to other states.

- Delaware: A haven for retirees due to its lack of sales tax and inheritance tax. Additionally, Social Security benefits are not taxed, and the state has a flat income tax rate.

- Florida: Another popular choice for retirees, with no state income tax on Social Security benefits. Florida also has no income tax rate and no inheritance tax. Property taxes can vary depending on the location.

- Georgia: Offers a relatively low tax burden for retirees, with no Social Security tax and modest income tax rates. Property taxes are also moderate compared to other states.

- Maryland: Has higher income tax rates compared to other states on this list, but retirees can benefit from exemptions on retirement income. Property taxes can be high in certain areas.

- New Jersey: Known for its high property taxes, which can impact retirees on fixed incomes. Income tax rates are also relatively high. However, the state offers some deductions for retirement income.

- New York: While not as tax-friendly as some other states, New York does offer some tax breaks for retirees. There are exclusions for pension income based on age and income level, and property tax exemptions are available for seniors. However, the state's overall tax burden is higher than average.

- North Carolina: Presents a favorable tax environment for retirees, with moderate income and property tax rates. Additionally, Social Security benefits are not taxed.

- South Carolina: Offers attractive tax benefits for retirees, including no Social Security tax and a lower income tax rate on retirement income. Property taxes are relatively low.

- Pennsylvania: Imposes no tax on Social Security benefits, making it appealing to retirees who rely heavily on this income source. Income tax rates are moderate, and property taxes vary across the state.

- Tennessee: Another state with no income tax on Social Security benefits, making it appealing to retirees. However, it does have a high sales tax rate that could offset some of the savings from not having state income tax.

- Texas: A tax haven for retirees with no state income tax, including on Social Security benefits. This can significantly reduce your overall tax burden. However, property taxes can be high depending on the location.

Cost of Living: Balancing Expenses and Lifestyle

Another significant factor in assessing the best states financially for retirement is the cost of living. While some states may offer lower tax rates, their cost of living may offset any potential savings. Here's a comparison of the cost of living in all nine states:

- Alabama: Offers a relatively affordable cost of living, particularly in rural areas. Housing, groceries, and healthcare costs are generally lower than the national average.

- Delaware: While not the most affordable option, Delaware offers a moderate cost of living compared to neighboring states like New Jersey and Maryland. Housing costs tend to be higher near the coast, while inland areas offer more affordable options.

- Florida: The cost of living in Florida varies depending on location. Housing costs, particularly in coastal areas, can be higher than the national average. However, groceries and healthcare costs tend to be more affordable.

- Georgia: Offers a relatively affordable cost of living, particularly in rural areas. Housing, groceries, and healthcare costs are generally lower than the national average.

- Maryland: Has a higher cost of living, particularly in the areas surrounding Washington D.C. However, certain parts of the state offer more affordable options.

- New Jersey: One of the most expensive states in the nation, with high housing, transportation, and healthcare costs. However, the state's proximity to major cities and cultural attractions may justify the higher expenses for some retirees.

- New York: This state is known for its higher cost of living, particularly in New York City and its surrounding suburbs. Housing, transportation, and everyday expenses can be significantly above the national average. However, the state offers excellent cultural amenities, healthcare facilities, and public transportation options. To some, there is simply nothing better than living in or near NYC.

- North Carolina: Boasts a lower cost of living compared to many northeastern states. Housing, groceries, and healthcare are generally more affordable.

- South Carolina: Offers a relatively low cost of living, especially in coastal areas. Housing, transportation, and everyday expenses are generally lower than the national average.

- Pennsylvania: Presents a varied cost of living depending on the region. Urban areas tend to be more expensive, while rural areas offer more affordable options.

- Tennessee: Provides a relatively affordable cost of living, especially in areas outside of major cities like Nashville and Memphis. Housing costs, groceries, and healthcare expenses are generally lower than the national average. The state also has no income tax on salaries and wages, making it an attractive option for retirees.

- Texas: Offers a diverse range of living costs depending on the region. Major cities like Austin and Dallas may have higher housing costs, while smaller towns and rural areas tend to be more affordable. The state has no income tax, which can be a significant advantage for retirees. Groceries and healthcare costs are generally on par with the national average.

Access to Amenities and Climate

Beyond taxes and cost of living, many often prioritize access to quality healthcare, recreational activities, and cultural attractions when deciding what states are best financially for retirees. The climate also plays a role in determining the desirability of a retirement destination. Here's a glimpse of what each state offers:

- Georgia: Enjoys a mild climate with warm summers and cool winters. Offers diverse recreational opportunities, from beaches to mountains, as well as a thriving cultural scene in cities like Atlanta.

- Florida: A snowbird’s paradise, and a haven for those looking to permanently relocate to warmer weather. Florida is of course known for warm winters, and year-round beaches. There are a variety of outdoor activities including golf that are readily available to residents all year long.

- Maryland: Features a diverse landscape, from the Chesapeake Bay to the Appalachian Mountains. Offers access to major cities like Baltimore and Washington D.C., with numerous cultural and recreational amenities.

- New Jersey: Boasts beautiful beaches, charming small towns, and proximity to New York City. Offers a variety of recreational activities and cultural attractions.

- New York: While known for its bustling metropolis, New York also encompasses charming small towns, scenic landscapes, and picturesque waterfront communities. Experience four distinct seasons, with vibrant fall foliage, snowy winters, and warm summers perfect for exploring the Adirondack Mountains or the shores of the Hudson River. New York boasts world-class cultural attractions, museums, theaters, and a diverse culinary scene.

- North Carolina: Enjoys a moderate climate with four distinct seasons. Offers diverse landscapes, from the Blue Ridge Mountains to the Outer Banks. The state's Research Triangle is a hub for education, technology, and innovation.

- South Carolina: Offers a warm climate with mild winters, making it attractive to those seeking outdoor activities year-round. Coastal areas offer stunning beaches, while the Upstate region boasts picturesque mountains.

- Pennsylvania: Features a diverse landscape with rolling hills, forests, and major cities like Philadelphia and Pittsburgh. Offers a range of cultural attractions, historical sites, and outdoor activities.

- Tennessee: Home to the Great Smoky Mountains, rolling hills, and the musical city of Nashville. Enjoys a moderate climate with warm summers and mild winters, providing opportunities for outdoor activities like hiking, fishing, and exploring the state's rich musical heritage. Tennessee offers a relaxed pace of life, affordable living, and a friendly community atmosphere.

- Texas: Offers a diverse landscape with wide-open plains, scenic hill country, and vibrant coastal cities. Enjoys a warm climate, perfect for outdoor enthusiasts, with opportunities for hiking, fishing, golfing, and exploring historic sites. Texas is known for its friendly culture and rich history, with cities like Austin and San Antonio offering a vibrant arts and culinary scene.

Making an Informed Decision

Choosing the best state financially for retirement involves careful consideration of your individual priorities and financial situation. While taxes and cost of living are essential factors, don't overlook the importance of access to amenities, climate, and overall quality of life. Researching and visiting potential retirement destinations can provide valuable insights to help you make an informed decision.

Remember, the best state for you will depend on your unique needs and preferences. By weighing the financial and lifestyle factors discussed in this article, you can find the perfect place to enjoy your golden years.

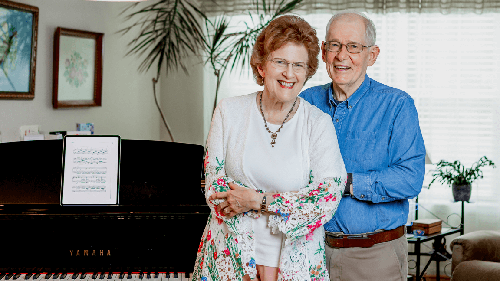

Acts Retirement-Life Communities operates beloved communities in each of these states. See if you can find a community that’s perfect for you.

More About Tax Benefits for Retirees

South Carolina Retirement Taxes

Taxes in Maryland for Retirees

North Carolina Taxes for Retirees