Understanding CCRC Pricing & Fees

The cost of retirement is something that’s first and foremost on many minds. This is only natural, as it’s important to ensure your retirement savings are enough to support the standard of living you’re looking for. Yet while retirement living can be an expensive endeavor, it doesn’t have to be. This is why continuing care retirement communities, or CCRCs, have become such popular choices lately. Here’s what you need to know about CCRC pricing and fees – and why they’re such an excellent choice for retirees.

What Are CCRCs and How Do They Work?

CCRCs, also known as life plan communities, offer residents a continuum of care, from independent living to assisted living, memory care, and skilled nursing care. Residents typically pay a CCRC entrance fee as well as a monthly fee in exchange for access to all of the community’s amenities and services, including healthcare. CCRC pricing can vary widely depending on the community’s location, size, amenities, and type of life care contract. However, there are some general trends that you can expect to see.

- CCRC Entrance fees: Entrance fees are typically higher, often to prepay for future healthcare needs, and can range from a few thousand dollars to several hundred thousand dollars, depending on the contract. Think of it as an investment in your future. The entrance fee is used, among other things, to subsidize the cost of care for residents who need it. With what is called a Type A life care contract, for example, should an independent living resident need a higher level of care such as assisted living, they will receive it for no additional cost, because it’s already covered via their entrance fees.

- CCRC Monthly fees: Ongoing monthly fees are obviously much lower than the one-time entrance fee, though depending on the CCRC the average range can be from $2,500 to $6,000. The monthly fee covers the cost of the resident’s living expenses, such as meals, housing, utilities, maintenance, and amenities such as pools, fitness centers, painting and woodworking shops, etc. It also often covers a host of entertainment and recreation options for community residents. For CCRC contracts that are not Type A, monthly fees may increase as the level of health need increases. For Type A, they typically do not, as the entrance fee has prepaid for many of these expenses. Monthly fees may increase for inflation, having nothing to do with health services received.

Contract Types for CCRCs

Moving into a CCRC typically requires signing a contract. There are three main types of CCRC contracts: Type A, Type B, and Type C. There are advantages and disadvantages to all three, so it’s important to understand what each contract offers and what you typically pay for these services.

- Type A: Type A contracts, also known as all-inclusive contracts, offer residents access to levels of healthcare such as assisted living or skilled care at little to no additional cost beyond the CCRC entrance fee and monthly fee.

- Type B: Type B contracts, also known as modified contracts, offer residents access to all levels of care, but residents may have to pay additional fees for assisted living and skilled nursing care, albeit at a lower cost than Type C.

- Type C: Type C contracts, also known as fee-for-service contracts, offer residents access to all levels of care, but residents must pay the present market rate for each level of care as they need it.

How a CCRC Can Be More Affordable in the Long Term

CCRCs do often represent an increased up-front cost when compared to other retirement communities that don’t offer continuity of care. However, in many situations, a CCRC can be more affordable in the longer term for several reasons. The first, and perhaps most important, is that healthcare costs are pre-planned upon move-in. That entrance fee CCRC residents typically pay is a form of pre-paying for future health needs. This means healthcare costs are contractually set at the time they move into the community, to plan for a day when assisted living or skilled care are needed.

With inflation driving healthcare costs higher every year, being able to freeze the costs of health services at their current rate is invaluable for peace of mind. It means you no longer need to budget for future health worries. Should you or your spouse ever need a higher level of care such as assisted living, it’s already covered. Even if health costs have continued surging over the years or decades.

That’s not all, though. CCRCs offer a variety of services and amenities that can help residents stay independent and healthy. This can delay the need for more intensive care. Additionally, economies of scale come into play with CCRCs as well. This is because CCRCs are able to negotiate lower prices for goods and services because they purchase on a large scale. This savings is passed on to residents in the form of lower monthly fees.

How CCRCs Can Save You in the Long Run

In many cases, living in a continuing care retirement community allows you to get the most out of your retirement savings, especially when it comes to controlling your healthcare costs. Of the total time someone spends at a CCRC, let’s say only the last third of that time is with a higher level health need. The payment structure of CCRCs ensures that your first two-thirds of the time in independent living is spent enjoying the amenities and bustling social life instead of wondering how much the last third in assisted living or skilled nursing care will cost. Since you can plan your budget from the day you move in, you’ll never have to worry if you have enough set aside for health needs.

Things to Consider When Choosing a CCRC

At this point, it hopefully makes clear financial sense to at least consider a CCRC for your retirement needs. However, not all CCRCs or life plan communities are created equal. You need to choose one with care to ensure it’s a good fit for you and your needs. When choosing a CCRC, it is important to consider all the factors, such as cost, location, and amenities. CCRC entrance fees and monthly fees can vary widely, so it is important to compare different communities. It’s also critical to choose a community that is close to your family and friends and one that offers the amenities and services you want. With some diligence on your part, you can find a CCRC that is perfect for all your retirement needs.

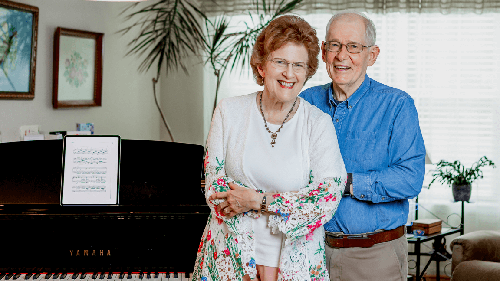

Want help finding a good location? Acts Retirement-Life Communities provide Type A Life Care, in addition to other variations of Type B and even rental options, in 28 gorgeous campuses across nine states. Secure your worry-free retirement with transparent CCRC pricing! Explore affordable entrance fees, monthly costs, and long-term savings. Explore these communities and get pricing information on retirement living near you now.